Santacruz Silver – Reviewing Q3 Financial And Operational Results, and Looking Ahead To Q4 and 2026 Growth Initiatives

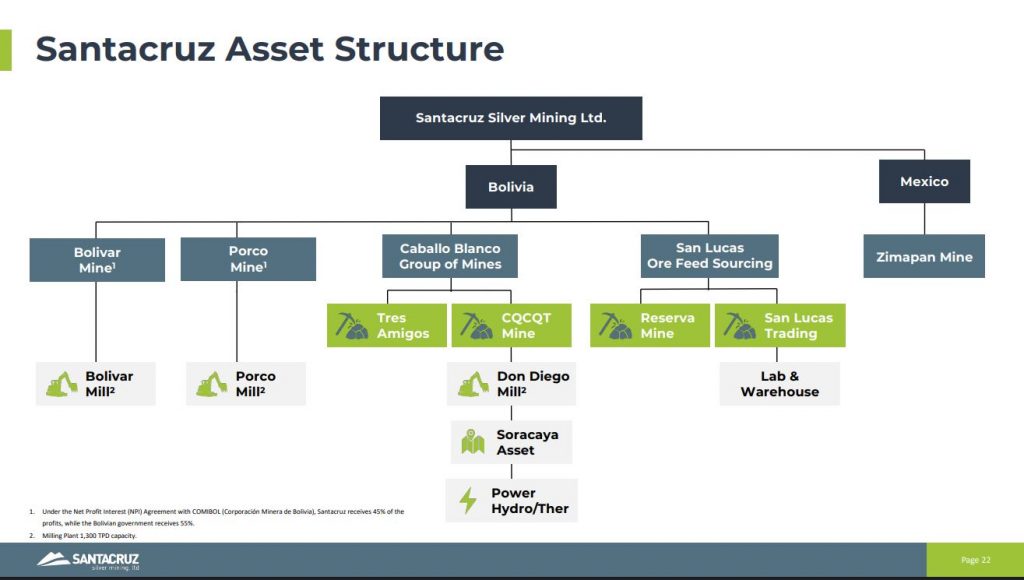

Arturo Préstamo Elizondo, Executive Chairman and CEO of Santacruz Silver Mining Ltd. (TSXV: SCZ) (OTCQX: SCZMF) (FSE: 1SZ), joins me to reiterate their decision to uplist onto the Nasdaq exchange in the US in early 2026, and to delve into the details of Q3 2025 financial and operational results across their portfolio of producing mines in Bolivia and Mexico.

On October 28th, the Company announced that it has applied to list its common shares on the Nasdaq Capital Market (NASDAQ); as a significant milestone in Santacruz’s growth strategy. We discussed how a big board US listing will increase transparency and liquidity to an expanded American shareholder base, and he explains the rationale for going with the NASDAQ over the NYSE. Santacruz Silver paid off their loan to Glencore in September, and is generating record revenues at current metals prices; so they are in a totally different financial position than a pre-revenue junior resource stock that goes through a share consolidation. The only real change will be a higher share price and a reduced number of outstanding shares post-consolidation, simply to meet the NASDAQ listing requirements.

Q3 2025 Highlights (noted in US dollars)

- Revenues of $79.99 million, a 2% increase year-over-year.

- Gross Profit of $20.17 million, a 28% increase year-over-year.

- Net Income of $16.34 million, a 7% decrease year-over-year.

- Adjusted EBITDA of $19.51 million, a 67% increase year-over-year.

- Cash & Marketable securities of $59.23 million, a 225% increase year-over-year.

- Working Capital of $69.20 million, a 186% increase year-over-year.

- AISC per silver equivalent ounce sold of $35.62, a 30% increase year-over-year. This increased AISC was temporary for this quarter due to brief change currency FX exchange rates, Bolivar dewatering initiatives and reduces production in the quarter, and the development investment at the 960 level at Zimapan.

- Silver Equivalent Ounces produced of 3,424,817, a 30% increase year-over-year.

Arturo guides us through a comprehensive review of all their producing operations starting off addressing how Q3 captured the largest impacts of the water inflow event that first occurred at the Bolívar Mine in May 2025. Since then, their operations team has strengthened the pumping system at Bolívar, with the fourth line commissioned in September and then the installation of a fifth submersible line in Q4; which together have increased total pumping capacity to 340 liters per second (l/s). These improvements are facilitating the gradual dewatering and recovery of the affected zones in the Bolívar mine and production is ongoing. The Company expects production from the high-grade Pomabamba and Nané vein areas at Bolívar to resume in February 2026 and ramp up steadily through the remainder of the year.

Next we reviewed the strategic importance of the small but high-margin Porco Mine, giving the company a foothold and good visibility to the Potosi mining district. Then rounding out the review of Bolivian assets, we moved over to the low-cost Caballo Blanco Group of mines and the high-margin San Lucas Group Lucas feed sourcing business (which now includes ore blended from the Reserva Mine). Arturo highlights how the San Lucas metals sales helped offset the lower silver production at the Bolívar Mine in Q3, and will do so again in Q4, providing a great defensive and growing asset inside their portfolio.

In Mexico, Zimapán continued to deliver stable production, reflecting consistent plant throughput and recoveries. Part of the reason for higher costs in Q2 and Q3 have been all the equipment and development work invested this year into accessing the higher-grade 960 Level at the Zimapan Mine. This 960 Level is starting to contribute more in the latter part of the Q4 production profile from Zimapan, but will be more significant in Q1 of 2026 and beyond, with capital investment coming down, and grade and metal recoveries going up.

Wrapping up we looked ahead to 2026 and discussed future growth through exploration around current mines, the development of the Soracaya Project, and the potential for future accretive acquisitions in the Americas.

If you have any follow up questions for Arturo regarding Santacruz Silver, then please email those to me Shad@kereport.com.

- In full disclosure, Shad is a shareholder of Santacruz Silver at the time of this recording, and may choose to buy or sell shares at any time.

For more market commentary & interview summaries, subscribe to our Substacks:

The KE Report: https://kereport.substack.com/

Shad’s resource market commentary: https://excelsiorprosperity.substack.com/

Investment disclaimer:

This content is for informational and educational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any security. Investing in equities and commodities involves risk, including the possible loss of principal. Do your own research and consult a licensed financial advisor before making any investment decisions. Guests and hosts may own shares in companies mentioned.

Click here to follow the latest news from Santacruz Silver

.

.

Another trick up the EU sleeve is to collect capital gains tax on unsold assets

I will have to give this thread another listen because Arturo’s mike and my speakers don’t like each other, 😒.

I am curious to the San Lucas ore as it sounded like they buy some of the feed silver from local mining operations done by individuals and small groups plus SCZ helps the locals with training courses and safety equipment. This sounds almost unofficial and may not blend as well with a Nasdaq listing but pulls at my heart-strings for them to stay with the listings they have. I guess what I am saying is I hope SCZ doesn’t lose their charm through this Nasdaq listing.

Hi Dan. What Santacruz Silver is doing with their San Lucas business unit in Bolivia is very above-board, and the government loves it as they are now getting paid taxes that the artisanal and smaller-scale private mining groups would have likely dodged and not paid. Then for the small miners, because it is so above-board, they get paid a lot more for their silver and base metals, and don’t have to do the more environmentally riskier processing, because Santacruz processes the ore for them professionally, and then makes a nice margin to do so.

The additional safety courses and proving small miners with some safety equipment is a way they are giving back to the community, and surely everyone is better off with them sharing best mining practices versus them not doing that.

As for the Nasdaq listing, it will simply increase liquidity and exposure (which can be a 2-way street based on the trend in the metals and the miners). Most of their peers like Avino, Endeavour Silver, First Majestic, Hecla, Coeur, Fortuna, etc… have a big board listing and get more inflows and ETF inclusion as a result.

I have concerns about the perception through the Nas looking glass, however, this may also be a call for all the Mills in the PMs to take local feedstock.

I think they have have what it takes after paying $50m off in one year with a bank roll to boot to be on the Nas… I’m nervous about this company suddenly becoming a $12+ stock and subject to a new set of vultures, 🤣

Dan, when SCZ reaches $12 we will be peering through champagne bubbles while the vultures circle. Cheers!

Auturo said there will be a 4 to 6 times consolidation to get the price up well over the $4 US limit.

Hi Dan. Yes, good point that being on the big board with the Nasdaq could cut both ways. It could lead to a much more active options market, or more downside pressure if funds or momentum investors hit it harder during sector corrections.

Still, for most of the big board listed peers like ASM, EXK, HL, CDE, FSM, and previously GATO, SILV, or MAG the extra liquidity and participation from US investors gives that influx of investor capital a place to go. So many funds or even US trading platforms don’t allow for investment in OTC stocks.

I’m on a roll! Italy to Seize $300 Billion in Gold as Debt Crisis Explodes – Tether already did it! The Daniel Cambone Show! DT 🤣🤣🤣

https://www.youtube.com/watch?v=jFmKTz_GxK8